Non-Filers (Income over $100,000)

Jul 07, 2022

The IRS has been busy. While the service is backed up on all processes and customer service is practically nonexistent, the IRS has been plotting who they will nab next! The IRS has identified their plan to reduce the tax gap of 1 trillion dollars. The tax gap is the difference between what the whole of taxpayers should pay, and what they actually do pay. Yes, that’s 1 with 12 zeros behind. It looks like this $1,000,000,000,000. I’m older, in my sixties actually, so I’m guessing that more than half of you who read this won’t remember back, decades ago, the National Debt was approaching a trillion dollars for the first time! The national debt first topped one trillion in 1981. I was twenty. It was THE news, kind of like Covid has been lately. At the time it seemed like the world was going to end. Everyone was talking about how will we ever be able to pay that ungodly sum off. We were selling off our children’s future. It was the ruin of the nation! That was the news anyway. Now, we could only wish it was that low now. I looked up that national debt today. It’s $34 trillion. I saw a calculation that if you include the promised, yet unfunded social security and Medicare, it is closer to $145 trillion. Interest alone on that would be over a trillion dollars each year. In any case, the IRS believes that there is a trillion dollars on the table, and they are going after it. They are extremely short staffed, so they are identifying the most lucrative people to go after. These are the people the IRS thinks they can collect the most money from and the fastest. If you make over $100,000 and haven’t filed in a few years… Congrats, you are the lucky winner. YOU are on that list. You are the one the IRS has identified to go after with laser focus.

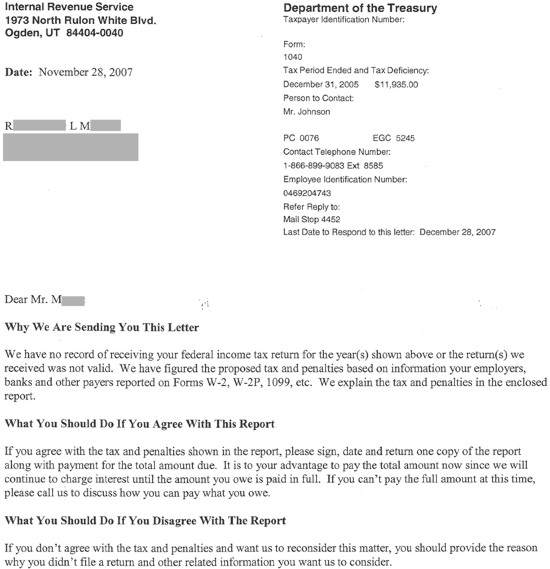

So, once the IRS finds you, what are they going to do? If you are lucky, they will start with filing returns FOR YOU. Nice of them ey. They will give you the worst filing status, no credit for dependents, and worst of all, if you are self-employed, the IRS will not offset some of your income with any business expenses. Nothing. They will try to calculate the most you can possibly owe. Then they will send you a notice of what they are doing to you. If you don’t reply timely, and it doesn’t matter if you’ve moved and never got the letter, the debt that they created for you is legally due. You owe this hyperinflated tax return by law.

Then the collection letters start. In many cases, most cases actually, they do this process of filing your returns for you for multiple years at the same time. I’ve seen them create debts of over a million dollars. It’s generally a lot more than you would have ever owed and in just about every case I’ve seen, more than you could ever pay.

For bigger balances due like this, they assign a person directly to your case. They are called Revenue Officers. They have power. They are probably the most powerful collection person in the US. They will come to your office or home and knock on your door to introduce themselves. Always be nice when they show up, but if you are wise, you won’t talk to them. I’m telling you the truth… you need professional help at this point. A professional cannot undo what you say in that first meeting. The questions may seem harmless, but they are specifically designed to hang you high. It’s better to speak with a professional who does this type of work before that conversation, and at that point (99 out of a 100 times), the professional will do all the talking for you and you won’t be speaking or appearing before them. I’m serious about this. If you speak with the IRS agent, you will regret it. So will your professional, because you are starting this process at a GREAT disadvantage, and believe it or not, could be the difference between going to jail or not. If the balance is that large, the risk is that big. The big takeaway is that when they show up, greet them, and find out who they are. Then TELL THEM that you want to get professional help. They will almost ask you if they can ask you a few questions first, while they are out there. DON’T DO IT. Be firm and tell them you are going to get a professional to help you. You can call a CPA, an EA (Enrolled Agent) or an attorney, and they can represent you through this process.

What is next? After the IRS files returns for you, or if you file and the IRS comes to collect, the tools of the IRS to collect taxes are powerful. They can take your bank accounts. Clean them out completely, not leaving 1 cent. They can garnish your wages, meaning they can send a letter to your employer stating that your paycheck from that day forward belongs to them. They can take your stuff too. Your car, your investments, your retirement, even your house. But it’s harder to take your house than a lot of things. Most of the above they are a letter away from owning what you used to own. But a house is harder to outright take. So, in many cases, instead of directly attacking your house, they file a lien against all your assets which includes your house. While the lien generally isn’t that big of deal, it is when the IRS has taken your bank accounts and garnished your wages. If you can’t pay the mortgage the bank forecloses on your home, the IRS will be at the closing with their hand out. After the bank gets paid, the IRS gets the rest. They didn’t have to work at all for it.

I know this all seems scary. To be honest, it should be. I see this type of stuff all the time. Those horror stories about the IRS, well, they are true. Especially if you haven’t filed and owe a lot of money. They label you as an Abusive Tax Avoidance non filer. You are first on their list to go after, and they don’t care if you like them or not.

Now, at the beginning of this, you probably noticed I said “If you are lucky” the IRS will do thus and so. And none of that was pretty. OK it’s downright ugly. But…

If the IRS doesn’t contact, you and you are a high income non filer it may be that there is a criminal investigation going on in the background. They don’t tell you this. The investigation goes on in the background. You don’t know until they show up with guns and badges. They usually show up in twos, and yes, they have badges that state they are criminal investigators, and they do carry guns. Sometimes they show up in groups. I’ve seen more than once that they showed up like a swat team. One client was in the bathroom when they came in. He thought it was a joke. Until he came out to find himself lit up like a Christmas tree (his words) and viewed a room full of overturned desks and people hiding behind them pointing the laser sights of loaded guns in all his kill zones. I think he would have liked to return right back to the bathroom, for a variety of reasons. But they would not let him. They took him to jail. Yes, people really do go to jail for not filing their required tax returns. With this huge focus of the IRS, now more than ever, it’s time to get back in the system and file some overdue tax returns.

Let’s go back to the Revenue Officer I mentioned before. He is NOT a criminal investigator. However, he is trained to identify cases that have what they call “badges of fraud”. In other words, what lengths did you go to, to not pay the taxes when you decided not to file? Did you claim a lot of dependents so there would not be much tax withheld? Did you take steps to hide money? Did you put money out of reach so the IRS wouldn’t be able to find it? Did you lie during that fateful first meeting? Did you admit to being a non-filer. Do they have a feeling that you did anything to avoid paying taxes? They can refer it to the criminal division at any time. Then we go right back to the IRS showing up in pairs with guns and badges.

Here is a big piece of knowledge that you MUST know. If they ask you WHY you didn’t file its damning. I’ve heard so many clients tell me that they didn’t file because they didn’t have the money to pay the IRS. Seems innocent enough. Unless you understand the law regarding criminal tax evasion. If you don’t file for the purpose of not paying, you just admitted to criminal tax evasion. You knew you had a filing requirement, and you chose not to file to hide it. Once you tell them that, it’s hard for anyone to overturn what you just told them. Believe me, they are taking notes and are trained to look for this type of thing. They do their best to ask these types of questions in that first interview. They know that many people will call a professional afterwards. So, they will take advantage of that first interview while you think you can talk your way out of it. They know you don’t know how damning a simple answer can be. THIS is why most professionals will protect you to the best of their ability to keep you from ever talking with the IRS.

So, what now? Can you avoid all this? The first thing you can do is file “all outstanding tax returns”. If they show up and it’s not a criminal case that’s what they will ask for. To the uninitiated, all tax returns would mean, well, ALL tax returns. But if you have knowledge, you will understand that the IRS’s own bible, the Internal Revenue Manual, states that ONLY the last 6 years are required to be considered in current compliance. It’s a real bummer to file 10 or 15 years’ worth of tax returns that show huge balances only to find out later you would have owed a lot less if you understood the rules. Once you file them, you can’t take them back, even if they weren’t necessary. The older the tax the higher the penalties and interest. You can really hurt yourself by filing these old returns, and it’s doubly painful if you find out later they weren’t even necessary. To help you understand why they aren’t necessary you have to look at the criminal statute of limitations. They have 6 years to prosecute you criminally, so beyond that they just aren’t as interested. That is why the Internal Revenue Manual tells them not to demand more than 6 years. The Internal Revenue Manual is their instruction book on how they are supposed to conduct business. But if you don’t know what it says, you can really hurt yourself.

That’s where it all starts. File your taxes and get them into the system as soon as possible. Do it before the IRS shows up. Then it’s just a collection matter. You owe the money, and we can take steps to get a solution on how to pay them back (or negotiate a settlement for less), but that’s all. Owing money is one thing… owning jail time is quite another.

I really can’t urge you enough to file. It’s a big deal. And perish the thought of taking the tax protestor position that the system is voluntary, illegal, or your income isn’t income for some reason. Add that argument to the fact that you make 100K and haven’t filed and I would guess that you are the number one likely person that the IRS will send to jail. I wrote another blog on the IRS’s power, and how it affects tax protesters. It’s scary, don’t do it. Click here to read more about it.

Just for the record, diyIRShelp.com DOES NOT PREPARE TAXES. The Do It Yourself (DIY) system is designed to help people who owe taxes. Once you file, you may want to come back and check out our modules on Payment Plans with the IRS, or the Offers in Compromise modules and how to settle for less than you owe if you can’t pay them fully. If you need help getting you back in the system you could call Advanced Tax Solutions, CPA, PC at 303-753-6040 (advancedtaxsolutions.com) they have been helping people get back into the system with the IRS for decades. I am the founder/owner of both companies. I’ve been hired by attorneys as an expert witness in Criminal Tax cases. I have also worked in the background of a criminal under Kovell agreements (I work for an attorney to be the accountant for the client in criminal cases so that many aspects of my knowledge is protected from IRS subpoena). After getting the returns filed, Advanced Tax Solutions, CPA, PC call also help with collection matters if you feel professional help would ease your mind. But, just so you know, if you try to do it on your own with diyIRShelp, whatever you pay for the Do It Yourself (DIY) module we will apply toward your retainer at Advanced Tax Solutions if you are not able to do it on your own. In other words, there is no risk to try it on your own, and if you decide you can’t do it alone, we will apply whatever you paid for the module toward your retainer at Advanced Tax Solutions, if you decide to have ATS to do it instead.

But it all starts with filing your taxes. And now more than ever it’s critical to get back into the system before they come knocking. Especially if you make more than $100,000. Do it now, before the IRS shows up. Doing nothing makes everything worse.